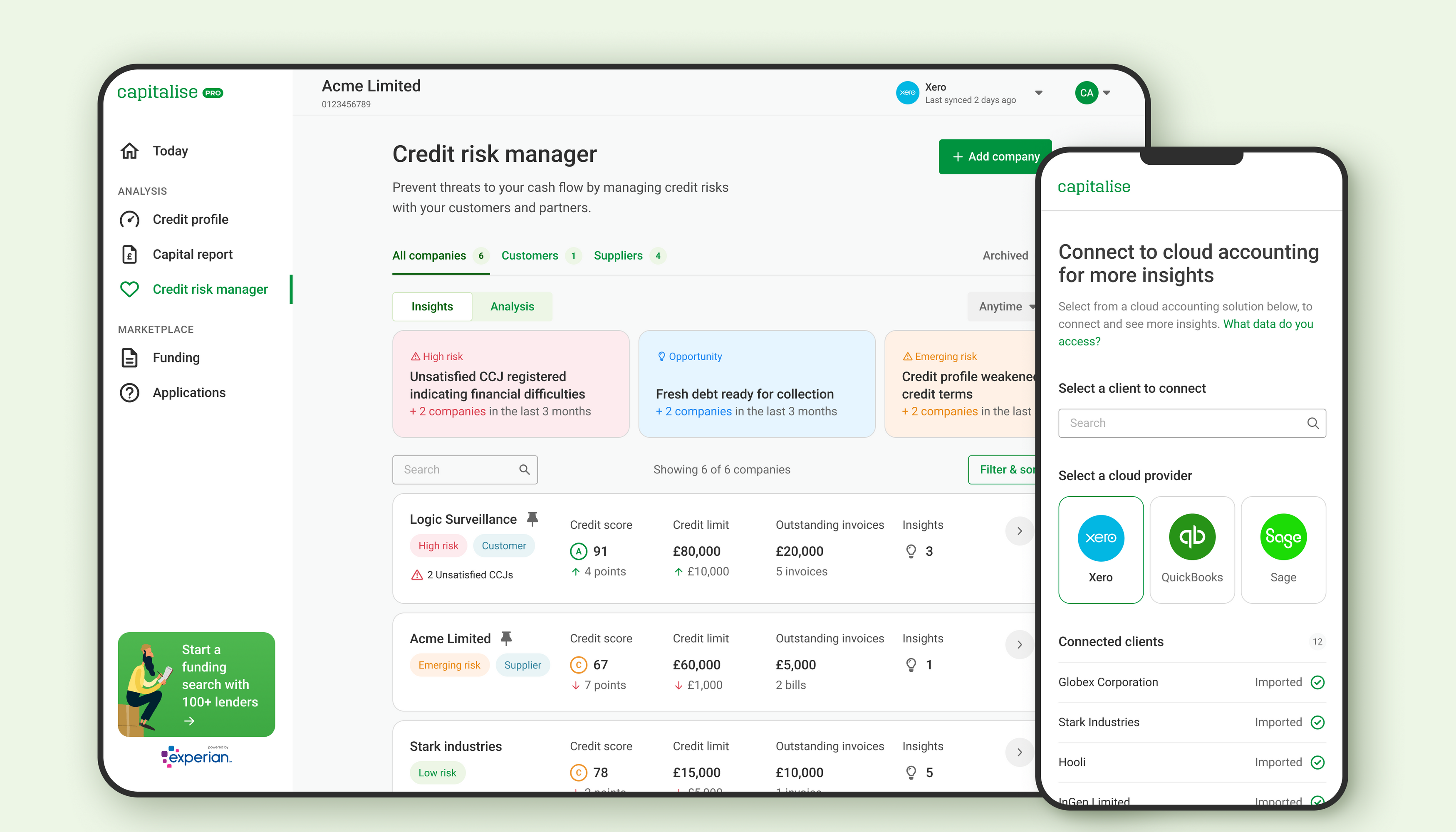

Capitalise.com gives small businesses transparency and control over their business finances.

Capitalise monitors the financial health for over 150,000 SMBs and has helped thousands of small businesses reach more than £2 billion in approved funding giving them much needed capital. We've build a partnership channel with over 2,000 accounting firms including many of the top 250 firms.

The opportunity

In 2016, after the 2008 Financial Crisis, bank branches were closing at fast clip and new financial products appearing every month.

Small businesses, with little time or experience, were disconnected from financial services.

Co-founders Paul Surtees and Ollie Maitland set about solving that customer challenge to make business finance more transparent and put business owners and their advisers in control.

The journey

A timeline of Capitalise's growth...

How we did it?

Using a research led approach the business was founded as a customer-first approach.

Strong data analysis identified cohorts with positive unit economics leading to a successful path to profitability.